Content

The new resident pays a tiny fee every month throughout their tenancy. The brand new LDR plan can be utilized to cover delinquent lease, tools, courtroom charges otherwise damages. Fill out the brand new landlord contact form here and you may a member out of our team will get in touch. Chasing off mother cosigners, which can get live out away from condition, is not enjoyable.

You ought to along with make your first payment away from projected income tax to own 2025 by the June 16, 2025. You can’t file a joint taxation get back otherwise create joint costs from projected income tax. Although not, while you are married to an excellent U.S. citizen or resident, see Nonresident Partner Handled as the a citizen inside the section step 1. If you make this method, you and your partner are treated to possess taxation aim as the residents for the entire taxation 12 months.

Build look at or currency order payable within the U.S. fund to help you Nyc State Tax and you can generate the very last five digits of one’s Societal Defense matter and you will 2024 Tax inside it. If you need to shell out a projected income tax penalty (discover range 71 instructions), deduct the newest punishment regarding the overpayment and you can go into the internet overpayment online 67. For individuals who changes household, or you are a great nonresident and the percentage of functions your create inside condition otherwise urban area change significantly, you need to notify your employer in this ten days. For additional info on once you can get are obligated to pay transformation or explore tax so you can New york, see TB-ST-913, Play with Income tax for folks (and Properties and you may Trusts). More resources for taxable and excused products or services, discover TB-ST-740, Quick Site Publication for Taxable and you will Excused Assets and you can Characteristics.

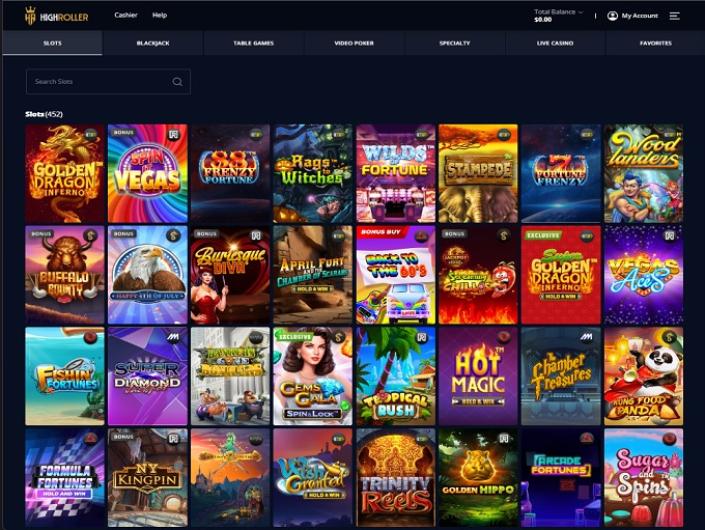

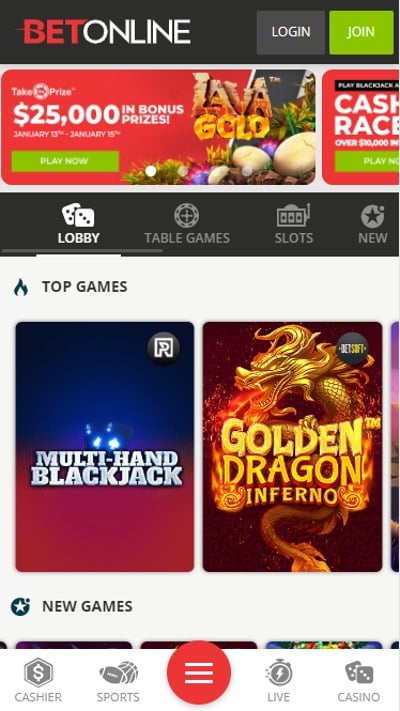

The best 100 percent free subscribe bonuses will give you to $50 within the a real income to try out its casino games rather than one exposure. The usa local casino marketplace is nevertheless apparently the brand new, meaning that i have only a number of no-deposit also offers readily available right now. Check out the latest 100 percent free greeting incentives and no deposit necessary regarding the greatest online casinos in just about any county.

A partnership that is in public traded often keep back taxation in your genuine withdrawals away from effortlessly connected income. When you’re an agricultural employee to the a keen H-2A visa, your employer need not withhold taxation. But not, your boss have a tendency to keep back tax only when your boss commit to keep back. In that case, you must render your boss which have a properly accomplished Form W-cuatro. For those who file the go back over 60 days following deadline otherwise lengthened due date, minimal punishment is the smaller from $510 or 100% of your unpaid tax.

Line 116 and you may Line 117 – Lead Put away from Refund

The newest Forms 1040 and you may 1040-SR added a great checkbox in the Processing Reputation part and then make the decision to remove the nonresident otherwise twin-status companion as the a great U.S. citizen to have 2024. To learn more, discover Nonresident Spouse Addressed as the a resident and you can Opting for Resident Alien Condition, later. In some cases, we may phone call you to definitely address your query, otherwise cost you more info. Do not attach interaction on the income tax return unless of course the new interaction describes an item for the get back.

Table A good. Finding All you have to Understand You.S. Fees

People feel that may result in withholding a safety deposit or terminating the brand new rent will be intricate in the leasing agreement. Within the D.C., casino 888 reviews play online landlords must place defense dumps within the interest-influence accounts and come back them with accumulated attention from the cancellation of one’s rent. Whenever obtaining a different property, landlords must take into account any current shelter deposits plus the accumulated interest on it.

Some of the credit unions searched provides highest-yield bank accounts, if you see a merchant account that fits what you’re lookin for, you simply will not feel you are limiting since there are a lot fewer issues and you will characteristics. Most other credit unions you’ll give advertising otherwise official bank account you to definitely are merely offered to participants whom see certain criteria. Including, when the a credit connection now offers a savings account for children, you probably won’t be able to open they for your self if you might be 35.

Nearer Connection to a foreign Country

Christina performed characteristics in the us for 60 days and you will did characteristics on the Netherlands to have 180 days. Utilizing the date cause for deciding the source out of payment, $20,100000 ($80,100000 × 60/240) try Christina’s You.S. resource money. Nonresident aliens are taxed just on their money from provide within the united states as well as on specific income related to the brand new run of a trade or company in america (come across section cuatro).

Should your resident comes to an end investing, you ought to go after your fundamental eviction actions. Once you’ve repossessed the fresh flat, you are purchased the overlooked lease around the newest visibility matter you have selected regarding sort of assets, or until the tool are re also-let, any type of happens basic. Dive assists potential people that do not meet your earnings or borrowing criteria. The most popular type of candidates try international citizens and no You borrowing from the bank, pupils and no money, more youthful benefits having slim borrowing data, and you may mind-employed someone.

Citizenship and you may Immigration Services (USCIS) (or their predecessor business) features awarded you a questionnaire We-551, Long lasting Resident Credit, known as a green cards. You continue to has resident reputation below so it test unless of course the newest condition is completely removed away from you or perhaps is administratively or judicially determined to own already been quit. Wait at the least 45 weeks in the date you mailed your own commission before you could phone call to verify bill.

Reduced amount of Park Services

You will have received this short article once you sold the connection. You should have obtained this short article once you bought the connection. Include one the main government amount which you gotten as you was a vermont Condition resident. Enter the matter your stated on the government go back and you will fill out a copy of federal Schedule Elizabeth (Form 1040). To find out if your be eligible for the newest pension and you can annuity income different, comprehend the guidelines to possess range 28.

Step 8: Enter into your repayments and you may credits

The next table listing a number of the usual guidance files and you will shows where to find the level of tax withheld. In order to allege the fresh adoption borrowing from the bank, document Mode 8839 together with your Function 1040-NR. For individuals who claim a foreign taxation borrowing from the bank, you will tend to have to attach on the come back an application 1116. In order to allege the new adoption borrowing, document Mode 8839 together with your Mode 1040 otherwise 1040-SR. A different laws pertains to people and you can organization apprentices who are qualified to receive the benefits of Blog post 21(2) of one’s United states-India Taxation Treaty.

See Scholarships, Has, Awards, and Prizes in the section dos to choose in case your scholarship are away from You.S. provide. While you are a worker and you discovered wages subject to U.S. tax withholding, you ought to fundamentally document by the 15th day of the newest last day after your tax seasons finishes. If you apply for the newest 2024 season, the return is born April 15, 2025. You must file Mode 1040-NR while you are involved with a trade or organization in the the us, or have most other You.S. resource earnings about what taxation was not totally paid back by the amount withheld. Fundamentally, you can not claim taxation pact professionals as the a resident alien. See along with Citizen Aliens under Certain Normal Tax Pact Pros in the part 9.